Global Courant

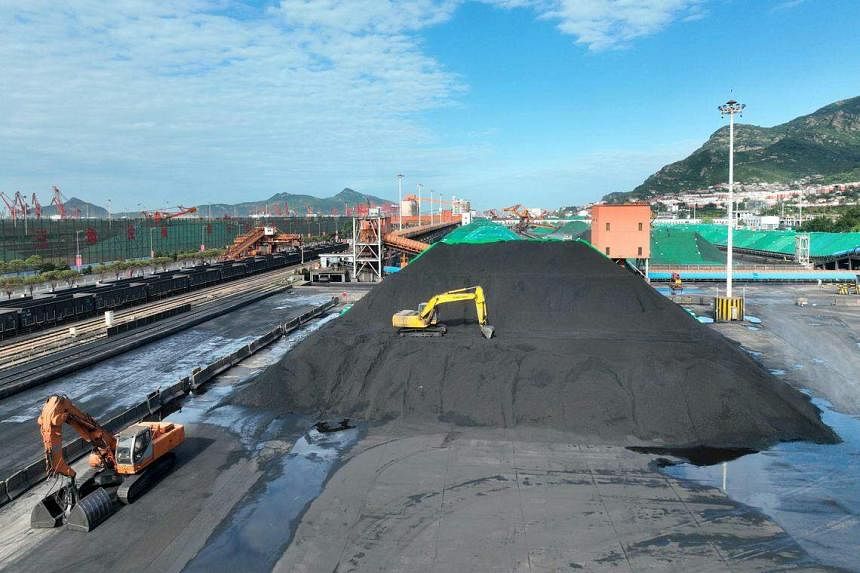

BEIJING — Falling coal prices could push Chinese imports to record highs as unwanted fuel elsewhere in the world is diverted to the largest consumer.

China’s purchases could reach 360 million to 380 million tons (about 326 million to 345 million tons) by 2023, according to the main industry association. That compares to 293 million tons last year and a record 327 million tons in 2013.

The country’s buying spree, particularly for the higher grades that its own miners struggle to produce, coincides with the easing of energy prices in the European Union from last year’s spike caused by the Russian invasion of Ukraine. That lures loads at discounted rates from as far afield as South Africa and Colombia.

While Beijing is keen to stock up on its main fuel as air conditioning demand surges into the summer, the additional volumes would flow into a market that is struggling with disappointing industrial consumption and already well-supplied by record domestic production.

“World prices have been hammered by weak demand in the EU and more shipments are coming to China rather than the EU or India,” Ms Su Huipeng, an analyst with the China Coal Distribution and Transport Association, told a briefing on Wednesday.

“Suppliers have lowered prices to seize sales opportunities in China after demand ebbed elsewhere,” said Ms. Su. It may take some time for the additional long-haul shipments to arrive and “might not account for imports in May, which could be lower than last month because the journey takes one to two months,” she said. China will publish its latest trade figures on Wednesday.

Imports in the first four months of the year were already at a breakneck pace, rising 89 percent year-on-year to 142 million tons. The increase came after China lifted its ban on Australian shipments and more Russian coal became available following sanctions from other buyers against Moscow.

Prices collapse

The benchmark price for thermal coal in Qinhuangdao, China’s main transportation hub, is down 28 percent this year and inventories in northern ports are at historic highs. International prices are down 63 percent. According to Mr. Hou Jian, another CCTD analyst, China’s own production is also expected to break records, rising to a whopping 4.7 billion tons this year.

“The worst may not have come yet and we are in the middle of a downward price cycle,” Hou said.

A string of gloomy economic data, including a second straight contraction in manufacturing activity in May, has fueled fears about China’s growth prospects and replaced the optimism associated with the economy reopening after the pandemic. But rising temperatures are now increasing power consumption, which should help absorb the additional imports in the coming months, Hou said.

A weaker coal market in the world’s largest consumer of the dirtiest fossil fuel could also be bad for the climate. “A sustained downward trend in coal prices could lead to a resurgence in carbon emissions” in the second half of the year, Bloomberg Intelligence said in a note. BLOOMBERG