Global Courant 2023-04-14 09:01:01

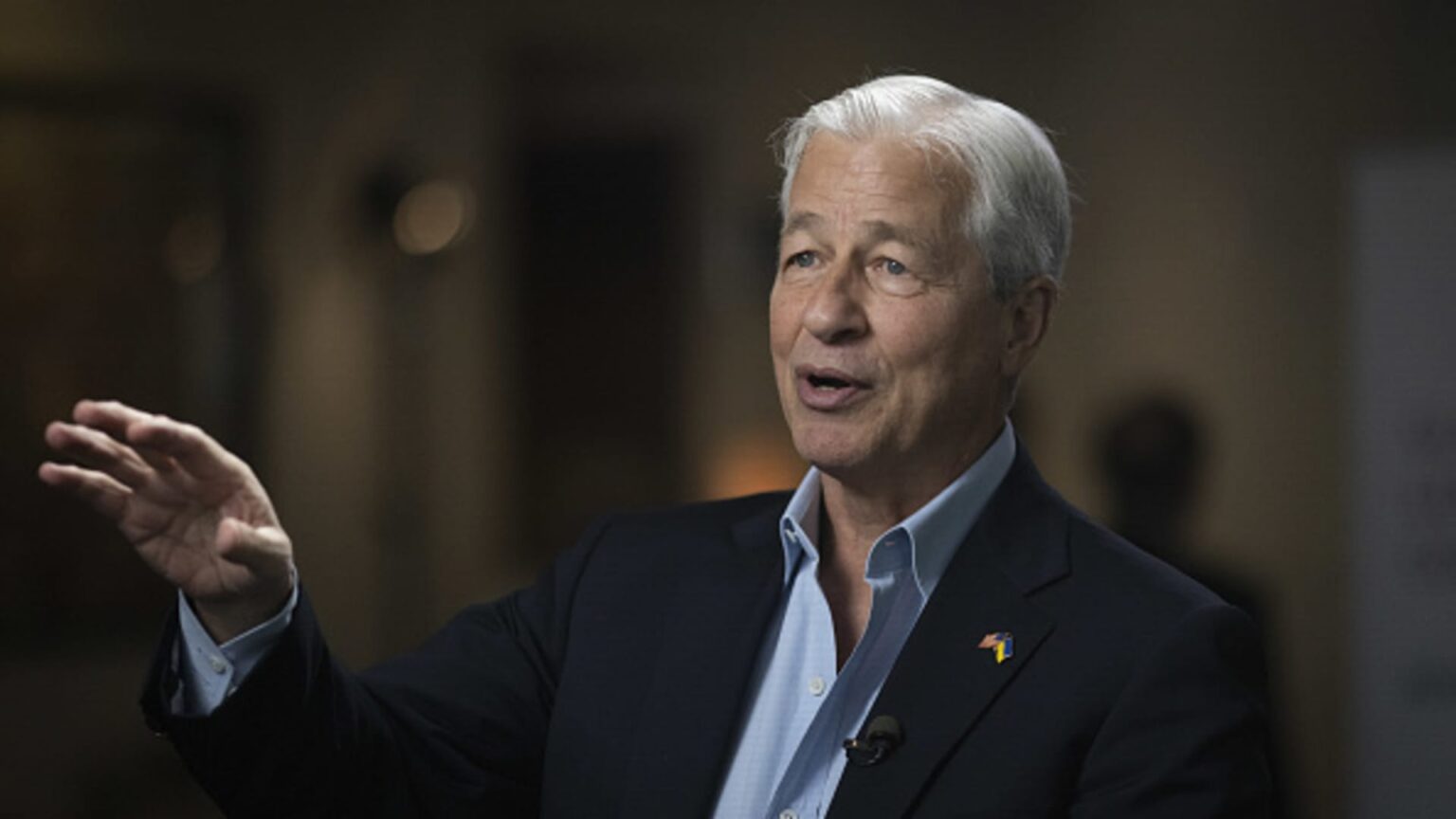

Jamie Dimon, Chairman and CEO of JPMorgan Chase & Co., during an interview with Bloomberg Television at the JPMorgan Global High Yield and Leveraged Finance Conference in Miami, Florida, U.S., on Monday, March 6, 2023.

Marco Bello | Bloomberg | Getty Images

JPMorgan Chase is scheduled to report its first-quarter results before the opening bell on Friday.

Here’s what Wall Street expects:

Earnings: $3.41 per share, up 29.7% from a year earlier, according to Refinitiv. Revenue: $36.24 billion, 14.7% higher than a year earlier. Deposits: $2.31 trillion, according to StreetAccount. Loan loss provision: $2.27 billion. Trading Income: Fixed income $5.29 billion, equities $2.86 billion.

related investment news

JPMorgan, the largest US bank by assets, will be closely watched for clues to how the industry fared following the collapse of two regional lenders last month.

Analysts expect a mix of conflicting trends. For example, JPMorgan likely benefited from an influx of deposits after Silicon Valley Bank and Signature Bank experienced fatal bank runs.

But the industry has been forced to pay for deposits as customers shift holdings to higher yielding instruments such as money market funds. That will likely curb banks’ gains on rising interest rates as the Federal Reserve tries to curb inflation.

The flow of deposits through US financial institutions is the biggest concern of analysts and investors this quarter. That’s because smaller banks came under pressure last month as customers sought the alleged safety of mega banks, including JPMorgan and bank of America. But the bigger picture may be that deposits are moving out of the regulated banking system at large as customers realize they can earn higher returns outside of checking and savings accounts.

Another key question is whether JPMorgan and others are tightening lending standards in anticipation of an expected recession in the US, which could hamper economic growth this year by making it harder for consumers and businesses to borrow money.

Banks have started to provision more for loan losses on expectations of a slowing economy later this year, which could weigh on results. JPMorgan is expected to book a $2.27 billion loan loss provision, according to StreetAccount’s estimate.

Wall Street may be of little help this quarter as investment banking costs are likely to remain low thanks to the still-closed IPO market. Chief Financial Officer Jeremy Barnum said in it February that investment banking revenues were on track for a 20% year-over-year decline, and that trading was also moving “a little bit worse.”

Finally, analysts will want to hear what JPMorgan CEO Jamie Dimon has to say about the economy and his expectations for how the regional banking crisis will unfold. JPMorgan has played a pivotal role in supporting a client bank, First Republicwhich faltered last month, in part due to leadership efforts to inject it with $30 billion in deposits.

Shares of JPMorgan are down about 4% this year, better than the KBW Bank Index’s 31% drop.

Wells Fargo And Citi group are scheduled to release results later Friday, while Goldman Sachs and Bank of America report Tuesday and Morgan Stanley announces the results on Wednesday.

This story is evolving. Check back later for updates.