Global Courant 2023-04-13 06:38:02

Investor legend Warren Buffett believes more bank failures could follow in the future, but savers should never worry.

We are not over bank failures yet, but savers have not had a crisis Berkshire Hathaway chairman and CEO told CNBC’s Becky Quick on “Squawk Box” Wednesday from Tokyo. “Banks will fail. But depositors will not be hurt.”

The collapses of Silicon Valley Bank And signature bank last month – the second- and third-largest bank failures in US history, respectively – prompted extraordinary bailouts from regulators, which backed all deposits with the bankrupt lenders and provided an additional funding facility for troubled banks.

The “Oracle of Omaha” said some of the “stupid” things banks do periodically came to light during this period, including mismatched assets and liabilities and questionable accounting.

“Bankers have been tempted to do that forever,” Buffett said. “Accounting procedures have led some bankers to do things that have helped their current earnings a little bit and created the recurring temptation to put a little bit more spread on the plate, a little bit more than earnings.”

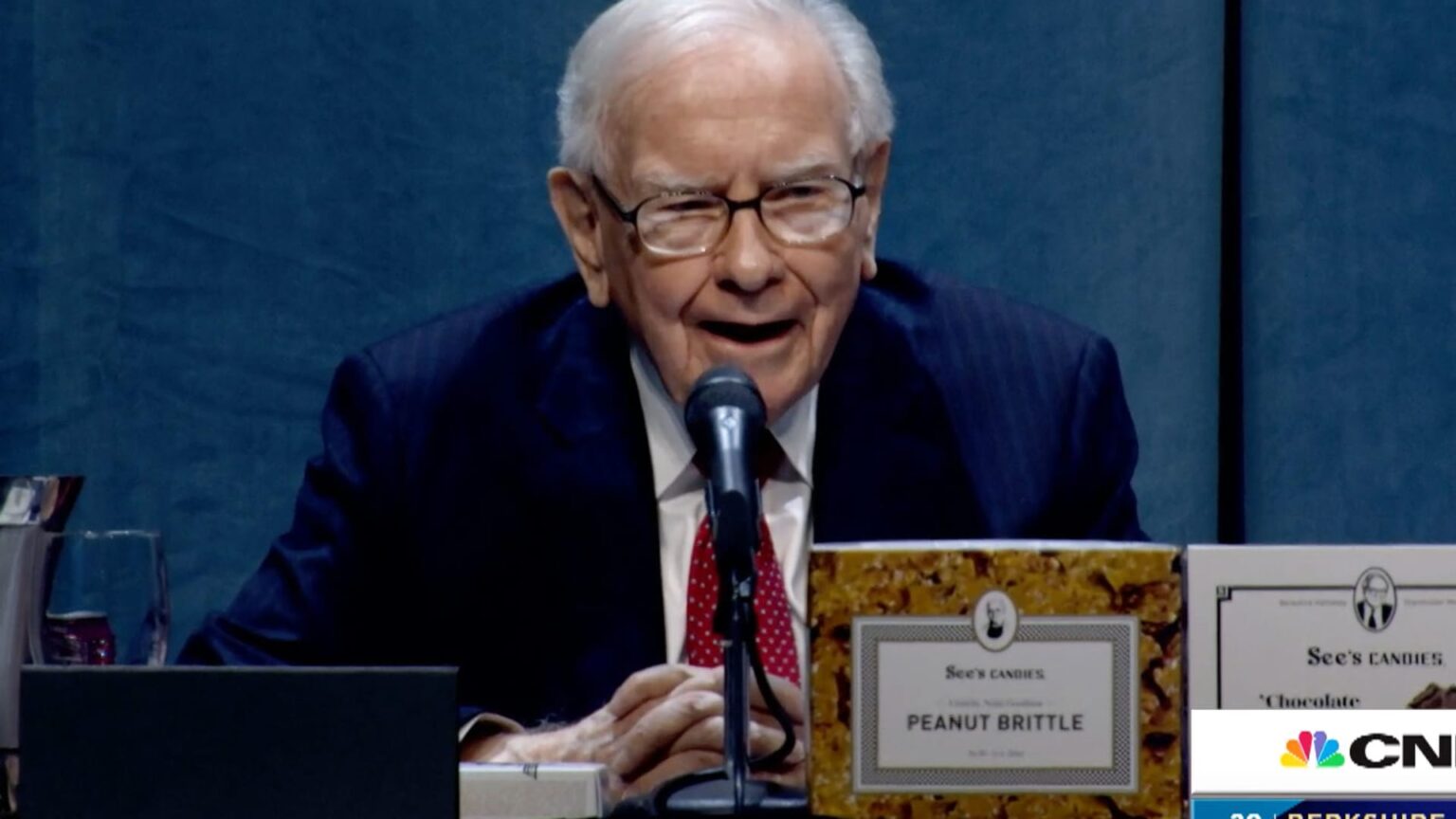

Warren Buffett at a press conference at Berkshire Hathaway’s shareholder meeting on April 30, 2022.

CNBC

Buffett said some bankers will continue this behavior and it will put shareholders in some stocks at risk.

But the 92-year-old investor said there was unnecessary fear and panic about depositors losing their money, when the system was set up to protect the country’s deposits.

“The cost of the (Federal Deposit Insurance Corp.) is borne by the banks. Banks have never cost the federal government a penny. The public doesn’t understand that,” Buffett said. “No one is going to lose money on a deposit in an American bank. It’s not going to happen…you don’t have to turn a stupid decision by managers into a panic among the entire citizenry of the United States about something they don’t do” You don’t have to don’t panic.”

He stressed that it is critical that banks maintain public trust and that they could lose that trust in seconds, as highlighted in the recent outburst.

Buffett has historically been a white knight for troubled banks. He came to fame Goldman Sachswith a $5 billion cash injection after the collapse of Lehman Brothers in 2008. In 2011, Buffett injected $5 billion into the then-beleaguered bank of America in a great show of faith.