Global Courant 2023-05-05 18:00:01

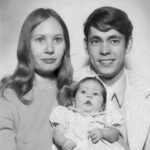

Upgrade CEO Renaud Laplanche speaks at a conference in Brooklyn, New York, in 2018.

Alex Flynn | Bloomberg via Getty Images

The technology industry is known for its innovation and producing the next big thing. But in a time of economic uncertainty and rising interest rates, a growing portion of the technology sector is going after one of the most uninnovative products in the world: yield.

With US Treasury yields rising to their highest level in more than a decade late last year, consumers and investors can finally generate returns by putting their money in savings accounts.

Banks respond to this by offering offers with a higher return. American Expressfor example, offers consumers an annual percentage return (APY) of 3.75%, and First citizensCIT Bank has an APY of 4.75% for customers with at least $5,000 in deposits. Online-only Ally Bank promotes a 4.8% certificate of deposit.

However, some of the highest rates available to depositors do not come from traditional financial firms or credit unions, but rather from companies in and around Silicon Valley.

Apple is the most notable newcomer. Last month, the iPhone maker launched its Apple Card savings account with a generous 4.15% APY in partnership with Wall Street giant Goldman Sachs.

Then there’s the whole fintech market, made up of companies that offer consumer financial services with a focus on digital products and a friendly mobile experience rather than physical branches with expensive bank clerks and loan agents.

Stock trading app Robin Hood has a feature called Robinhood Gold, which offers 4.65% APY. Interest is earned on uninvested money that is swept from the client’s brokerage account to partner banks. It is part of a $5 per month subscription that also includes lower borrowing costs for margin investing and research for stock investing.

The company raised its yield from 4.4% on Wednesday after the Federal Reserve approved its 10th rate hike in just over a year, raising benchmark rates by 0.25 percentage points to a target range of 5%-5.25%.

Fed Chairman Jerome Powell speaks at a conference at the Federal Reserve Bank of Chicago on June 4, 2019.

Scott Olson | Getty Images

“At Robinhood, we are always looking for ways to help our customers make their money work for them,” the company said in a statement. press release announcement of his walk.

Lending club, an online lender, promotes an account with a return of 4.25%. The company told CNBC that deposit growth in the first quarter of 2023 was up 13% compared to the previous quarter, “as savers sought to diversify their money at traditional banks and earn more savings.” Year-over-year, savings have increased by 81%.

And Upgrade, which is led by LendingClub founder Renaud Laplanche, offers 4.56% for customers with a minimum balance of $1,000.

“It’s really a trade-off for the consumer, between safety or the appearance of safety and yield,” Laplanche told CNBC. Based in San Francisco, Upgrade and most other fintech players hold customer deposits with institutions backed by the Federal Deposit Insurance Corp., ensuring consumer funds are safe up to the $250,000 threshold.

SoFi is the rare example of a bank chartered fintech, which it acquired last year. It offers a high-yield savings product with an APY of 4.2%.

The story is not just about rising interest rates.

Across the emerging fintech spectrum, companies like Upgrade are profiting, intentionally or not, from a moment of turmoil in the traditional financial sector. On Monday, First Republic became the third U.S. bank to fail since March, following the collapses of Silicon Valley Bank and Signature Bank. All three saw savers rush to exits as concerns about a liquidity crunch led to a cycle of doom.

Shares of PacWest and other regional banks have plummeted this week even after the orchestrated sale of First Republic to JPMorgan Chase was meant to indicate stability in the system.

After SVB’s collapse, Laplanche said Upgrade’s banking partners came to the company and asked it to ramp up fund inflows, in an apparent attempt to halt withdrawals from smaller banks. Upgrade outsources the money it raises to a network of 200 small and medium-sized banks and credit unions that pay the company for the deposits.

Used to be dead money

For more than a decade, before the recent rise in interest rates, savings accounts were dead money. Borrowing rates were so low that banks could not offer a profitable return on deposits. Also, stocks were in such trouble that investors did just fine in stocks and index funds. A subgroup of those with a stomach for risk got big in crypto.

As price of bitcoin rose, a number of crypto exchanges and lenders started emulating the savings model of the banks and offering investors very high returns (up to 20% per annum) to store their crypto. Those exchanges are now bankrupt after the collapse of the crypto industry last year, and many thousands of customers have lost their money.

There is some potential instability for fintechs, even those outside of the crypto space. Many of them, including Upgrade and Affirm, partner with Cross River Bank, which acts as the regulated bank for companies that do not have charters, allowing them to offer loans and credit products.

Last week, Cross River was hit by a permission order from the FDIC for what the agency called “unsafe or unsound banking practices.”

Cross River said in a statement that the order focused on fair lending issues emerging in 2021, and that it “does not place any restrictions on our extensive existing fintech partnerships or the lending products we currently offer in partnership with them.”

While fintechs generally face much less regulatory pressure than crypto companies, the FDIC’s action suggests that regulators are beginning to pay closer attention to the types of products that high-yield accounts should replenish.

Yet the emerging group of high-yield savings products is much more mainstream than what the crypto platforms promoted. That’s largely because the deposits come with government-backed insurance protections, which have a long history of safety.

Nor are they designed to be major profit centers. On the contrary, by offering high yields to consumers who have had their money in stagnant accounts for a long time, tech and fintech companies open the door to potentially new customers.

Apple has a slew of financial products, including a credit card and payment app, that work seamlessly with the savings account, which is only available to the more than 6 million Apple Card holders. Those customers reportedly made nearly $1 billion in deposits in the service’s first four days on the market.

Apple did not respond to a request for comment. CEO Tim Cook said on the company’s earnings call on Thursday, “We’re really pleased with the initial response to it. It’s been incredible.”

apple savings account

Apple

Robinhood, meanwhile, wants more people to use its trading platform, and companies like LendingClub and SoFi are building relationships with potential borrowers.

Laplanche said high-yield savings accounts, while attractive to consumers, are not at the core of most fintech companies, but serve as an onboarding tool for more lucrative products, such as consumer loans or conventional credit cards.

“We started with credit,” Laplanche said. “We think that’s a better strategy.”

SoFi launched its high-yield savings account in February last year. In its annual SEC filing, the company said offering high-yield checking and savings accounts drove “more daily interactions with our members.”

To confirm, better known as a “buy now, pay later” company, has been offering a savings account as part of a “full suite” of financial products since 2020. The return is currently 3.75%.

“Consumers can use our app to manage payments, open a high-yield savings account and access a personalized marketplace,” the company said in a 2022 SEC filing. An Affirm spokesperson told CNBC that the savings account is “one of the most many solutions in our range of products that empower consumers to manage their finances more intelligently.”

Against the backdrop of a regional banking crisis, savings products from anywhere but a national bank seem unattractive. But chasing returns involves at least a little bit of risk.

“City or Chase, feels like it’s safe,” Laplanche told the consumer. “Apple and Goldman aren’t inherently risky, but it’s not the same as Chase.”

– CNBC’s Darla Mercado contributed to this report.

WATCH: Consumers are spending more for the same items than they were a year ago