Global Courant 2023-05-15 10:40:27

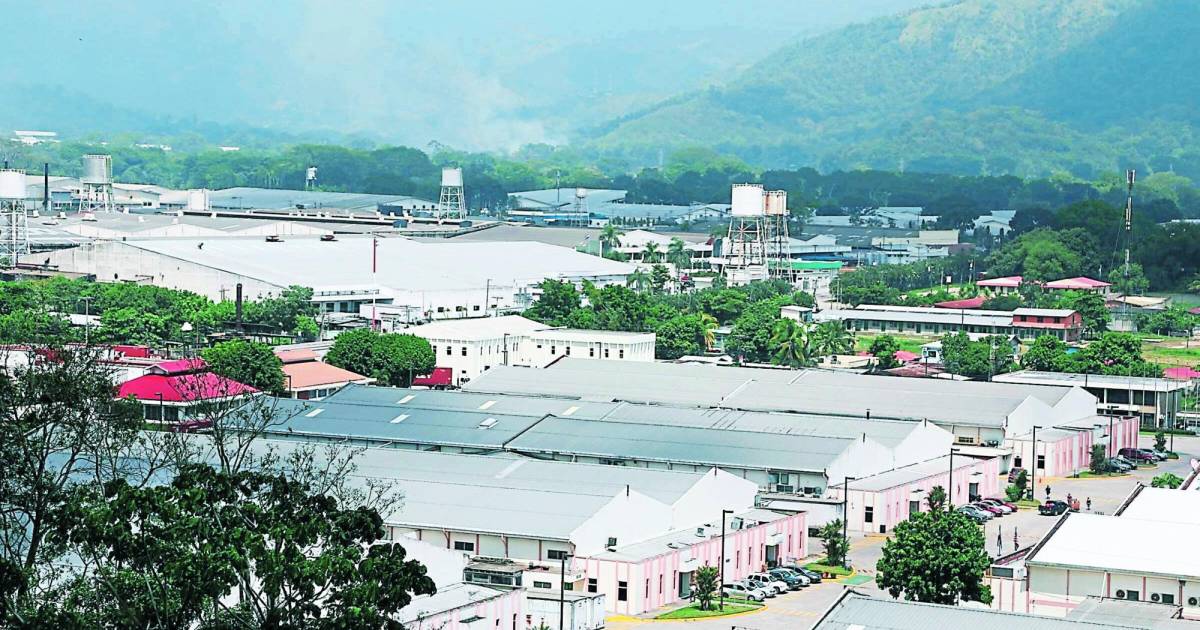

San Pedro Sula

Many things have been said about the Tax Justice Bill promoted by the government of Xiomara Castro.Although perceptions cover a wide range of opinions, both for and against the approval of the law, analysts generally agree that the “doomsday” scenarios that are often referred to do not represent a serious threat to the economic stability, at least not in the short term.

But that does not mean that the law is free of problems, since, in fact, it suffers from a lack of legal security guarantees when it leaves the discretion of an official to maintain or revoke tax benefits that, in principle, would have to protect.

Call of attention

One of the justifications that are used to promote the approval of the law is that it is presented as a solution for the abuses that are incurred through the special fiscal regimes, in which, according to its producers, situations often occur that lead to a certain number of taxpayers failing to comply with their tax obligations, a situation that has been maintained for decades.

keys of the law

> Maintenance of current benefits. The law establishes that tax benefits that have already been granted will be maintained until the expiration of the period established in the law that gave rise to them, but it also allows their revocation. > New legal figures. The law intends to create new legal figures such as the “final beneficiary”, in order to individualize assets and facilitate the collection of tax rates. > Bank secrecy for tax purposes. The regulation includes the elimination of bank secrets for tax purposes, allowing an exchange of information with other countries abroad. > Change in the concept of income Provides to change the concept of territorial income to worldwide, with which it intends to avoid that profits or gains abroad are exempt from tax.

“The problem with abuse is that we live in a country where it is easy to stop complying with tax obligations. So, the problem is that the state’s ability to control abuses has been, we would say, curiously, weak”, says the analyst Rodulio Perdomo.

The analyst also observes that countries like Honduras are subject to scrutiny by international organizations such as the Organization for Economic Cooperation and Development (Oecd) regarding Tributary legislation.

“They sent Honduras a warning in December 2021, in which they tell them that if they do not make changes, they will be considered a tax haven in full,” says Perdomo.

Data

> 14 laws, which include regimes with tax incentives, are the ones that the Tax Justice Law intends to eliminate, as established in article 15 of said project proposed by the Government. > 20 Years is the maximum time provided by the Tax Justice Law to enjoy tax benefits under the new proposed regulations, and this in case an extension is successfully processed.

According to the analyst, when a country is classified as a tax haven, it risks losing credibility, affecting its country risk rating and reducing its chances of obtaining financing in the international market.

“To a large extent the Tax Justice Law It is a response to that call for attention from the OECD, that we have to make the changes so that Honduras is not considered a tax haven,” says Perdomo.

The weak point

Another of the arguments that the detractors of the law use to justify their position is that, with the elimination of tax benefits provided for in the law, investments, the country’s competitiveness and jobs are put at risk.

It should be noted that, although the law does seek to repeal most of the special tax regimes and reduce them to just over two (called Yield and Free Zone Regime), also includes in its article 13 that “taxpayers who are fully or partially released from payment of the tax obligation will continue to enjoy the exemption benefit granted under the law that gave rise to it until its completion.” But other analysts draw attention to the other side of the coin.

“If the law only included that article, I would believe that there is a higher level of confidence, because many of (the existing benefits) their periods are going to expire within a considerable amount of time,” he says. Hannibal Calixfrom the portal My business, but adds that “the law also later says that these benefits can be eliminated through an administrative action; not like right now, that they are taken away from you only if you are defeated in court.”

According to Cálix, additional safeguards are needed in the law that prevent leaving the maintenance or revocation of the tax benefits granted to the discretion of an official.

To know

> Analysts recommend that the law that is finally approved be the product of the consensus of all parties.

“That is a situation of legal security. So, that is the situation that if the law causes a problem, the chaos that we are going to see causes a level of mistrust, and those are the things that the national or foreign investor considers himself”, says Cálix from which it can be deduced that the The law, as written, does carry a level of economic risk.

“That is exactly the problem of legal certainty established by the law, which does not give you that certainty that an official will not come and, at personal discretion, can take away a benefit from you”, points out Cálix.

According to experts consulted by this means, currently a beneficiary can challenge through the courts the cancellation of an exoneration before the Administrative Courts (numeral 13 of article 21 and article 187 of the Honduran Tax Code). But that is not the only gap that can be found in the law.

lack of tools

“I see a weakness, and that must be put on the table: competitiveness is not achieved only with tax exemptions. Economic development is not achieved solely by regulating exemptions. It is a step, but it is not the only one”, indicates Rafael Delgado, president of the Sampedrano chapter of the Honduran College of Economists (CHE).

This economist sees that the bill has room for improvement in the sense that very clear and precise provisions are added on the additional things that must be done to generate competitiveness.

“It is not only about cutting and better regulating tax exemptions, but about creating a comprehensive policy that has other instruments to generate competitiveness, to attract national and foreign investment, to create employment and to generate additional income for the population. So, I think that’s what it’s all about: a little more courage so that we don’t just stop at the elimination of what already existed, but rather at the creation of new legal tools that replace what is intended to be eliminated, Delgado postulates.

The economist recommends that, with the extra tax that is intended to be collected, at least part of it be allocated to the creation of competitiveness instruments that the country needs, such as a technical-vocational training system that prepares workers so that, when they enter the productive sector, they do so as skilled workers, with better salary prospects.

Above all, it must be avoided that the Tax Justice Law become an instrument that provokes the very corruption that it wants to combat.