Global Courant 2023-05-02 20:13:32

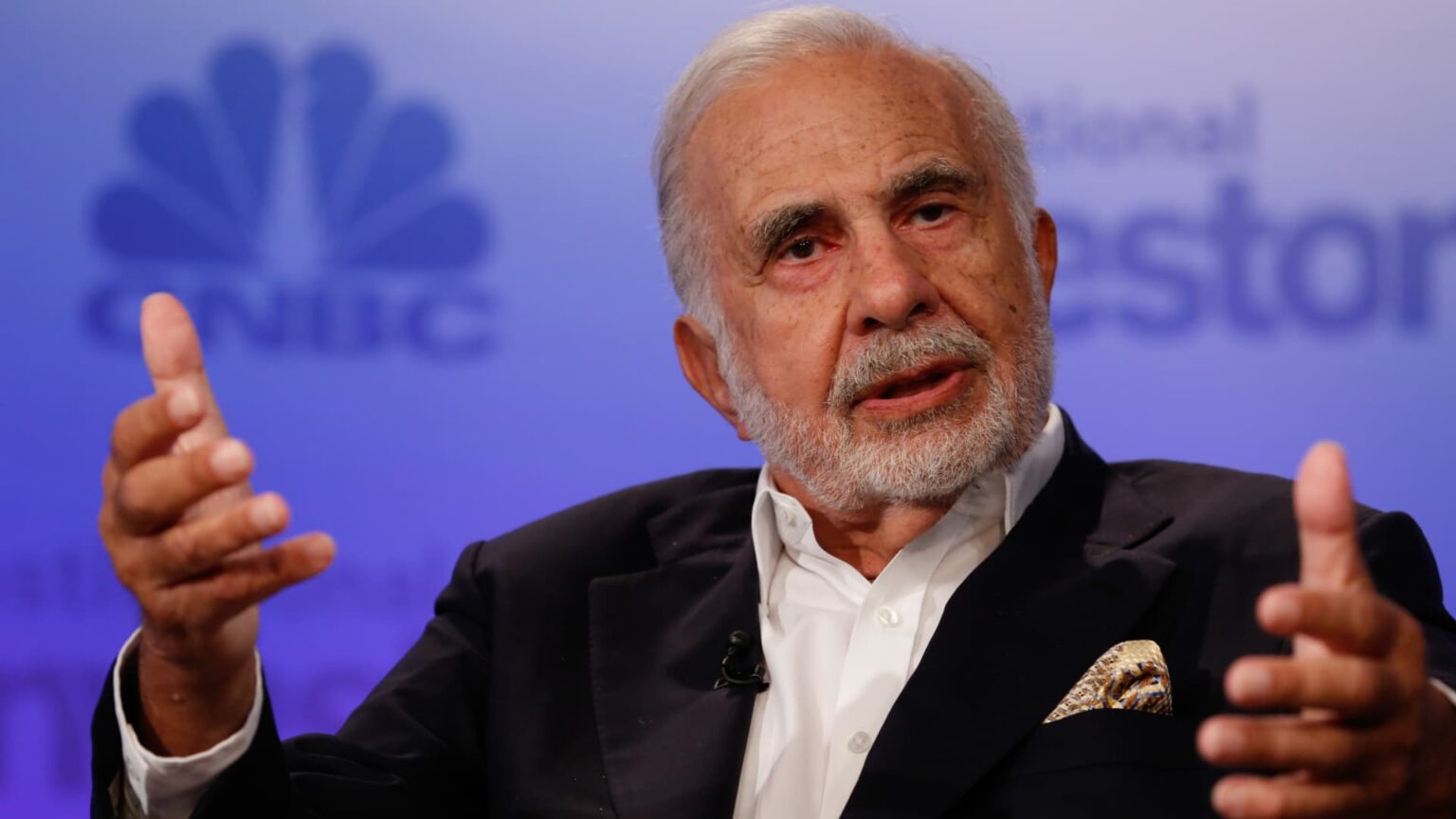

Carl Icahn speaks at Delivering Alpha in New York on September 13, 2016.

David A. Grogan | CNBC

Notable short seller Hindenburg Research goes after famed activist investor Carl Icahn.

The Nathan Anderson-led company took a short position against Icon Enterprisesamong other things due to “inflated” asset valuations, due to what it says is an unusually high net asset value premium in shares of the listed holding company.

“Overall, we think that Icahn, a Wall Street legend, made a classic mistake of exerting too much leverage in sustained losses: a combination that rarely ends well,” Hindenburg Research said in a note released Tuesday.

Shares plunged more than 12% in Tuesday’s trading.

Icahn, the most famous corporate raider in history, made a name for himself after he engineered a hostile takeover of Trans World Airlines in the 1980s and robbed the company of its assets. Most recently, the billionaire investor has engaged in activist investments in McDonald’s and biotech company Illumina.

Headquartered in Sunny Isles Beach, Florida, Icahn Enterprises is a holding company involved in a variety of businesses, including energy, automobiles, food packaging, metals and real estate.

The conglomerate pays a dividend of 15.9%, according to FactSet. Hindenburg said it believes the high dividend yield is “unsupported” by the company’s cash flow and investment performance.

CNBC has reached out to Icahn for comment.

Shares of Icahn Enterprises are down about 13% year over year.