Global Courant 2023-05-22 14:31:34

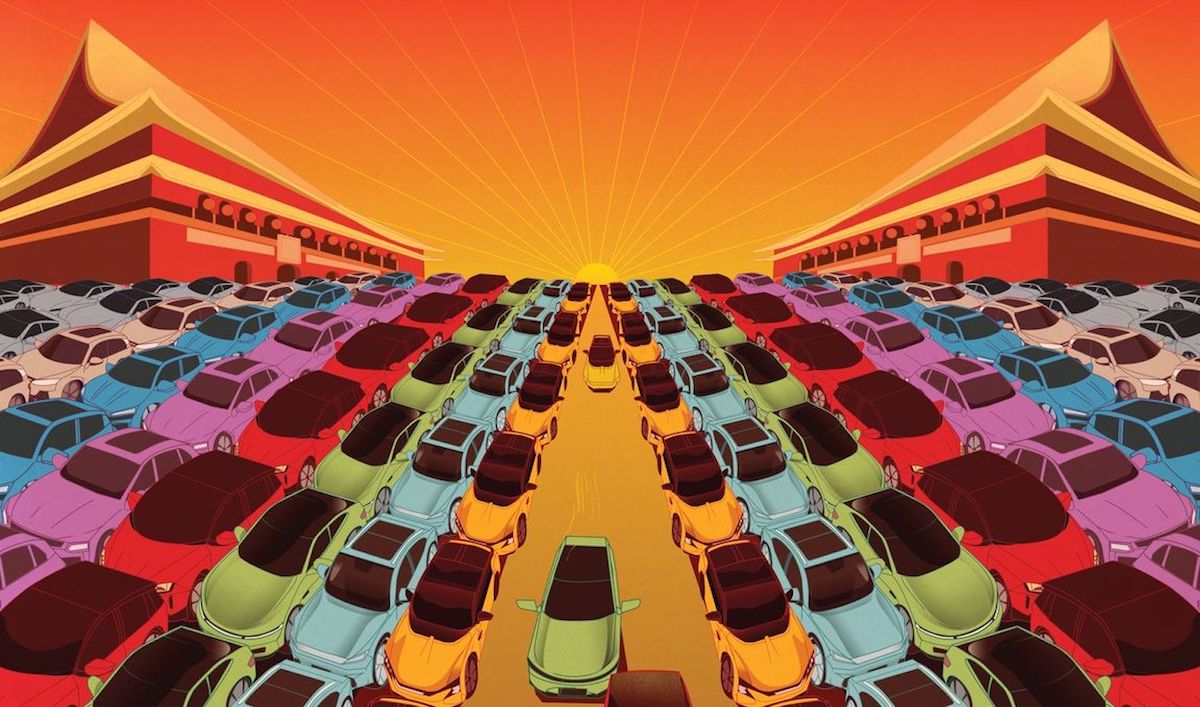

TOKYO — The Group of Seven (G7) called for the weekend to be a pivot away from China’s sprawling supply chains and Beijing’s rising economic power.

But new data on pivotal situations in the automotive world, released as G7 leaders signed their communiqué, reminded investors why it is too late for that.

China whizzed past Japan in the first three months of 2023 to become the world’s largest auto exporter. Key to the milestone: a 58% year-on-year increase in Chinese auto exports in the January-March period to 1.07 million units.

To make matters worse, the China Association of Automobile Manufacturers noted that the increase is partly due to deliveries to Russia. It is a clear reminder that the global sanctions against Moscow over the war in Ukraine are turning out to be more Swiss cheese than United Front US President Joe Biden envisioned.

Tokyo also got its own stark warning. The other big reason why China exports more vehicles than Japan Inc is the growing demand for electric vehicles (EVs). This is, of course, a market that Toyota Motor and other Japanese giants viewed with suspicion – to their growing disadvantage.

China didn’t, which explains why Elon Musk built his first non-US Tesla “Gigafactory” in Shanghai, not Yokohama. Tesla’s Chinese operation is currently the largest exporter of new energy vehicles. According to local media reports, Tesla had reached 90,000 domestic orders by September 2022.

“These are major market shifts happening at a rapid pace,” said Jorge Guajardo, partner at Dentons Global Advisors.

An aerial view shows hundreds of Tesla Model Y and Model 3 at the Gigafactory in Shanghai on January 2, 2020. Photo: Supplied

Economist Jack Gao of the Institute for New Economic Thinking adds: “You know this was going to happen one day. You know it’s EVs they hoped to beat the competition with, you know the size of the domestic market would play a key role here. Still, this happened quickly.”

Shanghai scored the Tesla factory was a major coup for then-local communist party boss, now national premier Li Qiang. China to surpass Japan in auto exports is arguably the most significant change of guard since 2011, when China overtook its regional rival in terms of gross domestic product (GDP).

It also highlights the kind of transformation Chinese leader Xi Jinping’s No. 2 promises to unleash in Asia’s largest economy. In March, Li assured global investors that the regulatory crackdown since late 2020 had run its course.

In recent years, Li said, “there were some inappropriate discussions and comments in the society, which made some private entrepreneurs concerned. From a new starting point, we will create a market-oriented, legalized and internationalized business environment, treat all types of property equally, protect the property rights of enterprises and protect the rights and interests of entrepreneurs.”

The new government, Li said, will “promote fair competition between different business entities and support the development and growth of private enterprises”.

What’s more, China’s automotive success is apparently attracting ever-increasing momentum. Domestic auto groups generally expect Chinese exports to grow 30% year-on-year in 2023.

This milestone can’t make Japan or the wider G7 very happy. 2009 marks 14 years since China became the largest new vehicle market.

Since then, Beijing has generally been more proactive than the US or Japan in helping to jump-start the EV market through tax or other incentives. China also saw building charging stations across the country as a means of creating jobs and growth in regional economies. That is now paying off.

In the first quarter alone, sales of electric cars and other new energy vehicles increased 93% year over year to 380,000 units. Such cars account for about 40% of China’s total exports. Belgium, Australia and Thailand are currently the main destinations for new energy cars produced in China.

For Japan, the Thailand piece of the puzzle is particularly ominous. Although often referred to as the “Detroit of Asia”, Thailand has long been dominated by Japan Inc. icons. If Thai chieftains decide that electric cars are the most lucrative bet, Japan may have to relocate factories.

All of this should also be a wake-up call for Detroit as Republicans try to reverse Biden’s policy of promoting EVs and greener growth in general. As the global market increasingly focuses on electric cars, General Motors’ gas-hungry trucks may not be able to meet demand abroad more than Toyota’s hybrid vehicles.

Thailand has doubled production of electric vehicles to stay competitive. Photo: Facebook

A question raised by all this: how could America, which invented mass production of cars, have fallen asleep at the wheel? Likewise, how could Japan, creating a better production mousetrap, have so blatantly lost the plot?

It’s worth noting that the Chinese threat that the G7 is so confident it can contain is just getting started in the auto space, many analysts say. China is still rolling out its own mass-produced EV line that will cost US$10,000 cheaper than major Western brands.

This test for China Inc remains natural. Certainly, the mainland success stories of Chery Automobile and Great Wall Motor are expanding sales in Russia at a rapid pace. However, it is unclear whether such companies funded by entities linked to Chinese municipal governments are able to thrive globally.

Still, the G7 makes it easier for China Inc to spread its wings. After Vladimir Putin’s soldiers invaded Ukraine in February 2022, Toyota, Volkswagen AG and others shut down Russian production facilities. Automakers on the mainland promptly stepped into the void.

According to Alpine Macro strategist Yan Wang, new car data solves a recent mystery. “Why,” he wondered, “is China’s trade surplus soaring? This is one of the reasons: car exports are exploding, while imports are plummeting.”

It’s a big problem. For Wellington-Altus Private Wealth strategist James Thorne, it is a sign that “the globalization theme is not dead”. And that “China is moving as it should – towards high value-added production and consumption,” adds Thorne.

There are many risks, of course, as the G7 focuses on supply chains vital for China to make high-quality cars – a likely sign of more tit-for-tat moves between the G7 and China.

In Hiroshima last weekend, G7 leaders stressed their plan is to “reduce risks”, not to disengage from China, while acknowledging the challenges posed by the mainland’s practices that they say are “disrupting the global economy “.

In its joint statement, the G7 stressed: “We are not disconnecting or turning inward. At the same time, we recognize that economic resilience requires less risk and diversification.”

G7 leaders added: “We will try to address the challenges posed by China’s non-market policies and practices, which are disrupting the global economy. We will counter malicious practices such as unlawful transfer of technology or disclosure of data.”

Still, the chance of additional curbs from Washington or Brussels remains high. Goldman Sachs economist Hui Shan doubts whether the United States Committee on Foreign Investment in the United States, or CFIUS, is done cracking down on China. There may be “more focus on refining existing tariff, export control and investment regimes once basic frameworks are in place,” says Hui.

“We expect them to be fairly narrowly focused on advanced semiconductors and related technologies, similar to last fall’s export controls, and do not expect significant restrictions on investment in secondary market portfolios,” added Hui.

Fully automated robots run at high speed at Geely Automobile’s Changxing base in Changxing Economic and Technological Development Zone in Huzhou city, east China’s Zhejiang province, August 4, 2021. Photo: AFP/Tan Yunfeng/Imaginechina

On Sunday, the Cyberspace Administration of China said products made by U.S. memory chipmaker Micron Technology had failed security assessments, deterring key infrastructure managers from buying from the company.

“Tensions between the US and China and technological decoupling could create periods of volatility in 2023,” said Union Bancaire Privée strategist Norman Villamin. “Relocations of supply chains from China could also slow activity via weaker foreign direct investment.”

Despite all the noise, China’s auto industry is shifting into high gear faster than many expected. The G7 may try to slow things down, but Beijing reminds Japan and its Western allies that China Inc. doesn’t sit still – and even races ahead.

Follow William Pesek on Twitter at @William Pesek

Similar:

Loading…